Newmont puts six mines, two projects on the block

Newmont will sell the Telfer mine, in Australia

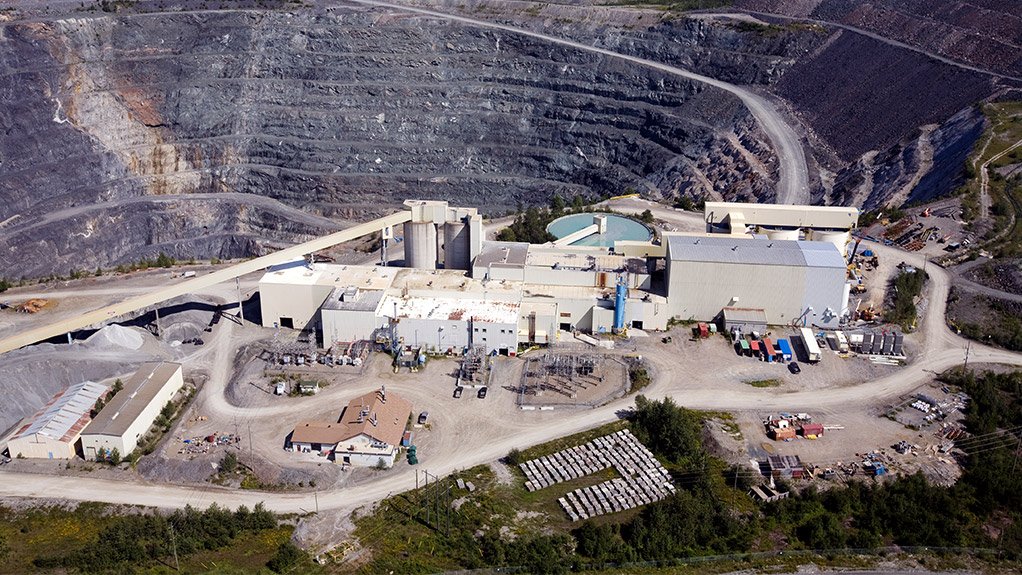

Newmont's Porcupine mine, in Canada.

Gold mining major Newmont will put up for sale six mines and two projects, optimising its portfolio to focus on ten tier-one assets that will produce 6.7-million gold ounces by 2028.

The six mines that will be divested include Éléonore, Musselwhite and Porcupine, in Canada, CC&V, in the US, Akyem, in Ghana, and Telfer, in Australia, as well as two non-core projects including Havieron, in Australia, and Coffee, in Canada.

Two of the assets that Newmont plans to shed – Telfer and Havieron – were acquired as part of the Newcrest acquisition last year.

Going forward, Newmont’s focus will be on six managed tier-one assets, including Boddington, Tanami, Cadia and Lihir, in Australia, Peñasquito, in Mexico, and Ahafo, in Ghana, as well as assets owned through two non-managed joint ventures at Nevada Gold Mines in the US and Pueblo Viejo, in Dominican Republic.

"Newmont's go-forward portfolio is the new standard for gold and copper mining," said president and CEO Tom Palmer.

It will also focus on three emerging tier-one assets, Merian, in Suriname, Cerro Negro, in Argentina, and Yanacocha, in Peru, and an emerging tier-one district in the Golden Triangle in British Columbia, where Red Chris and Brucejack are located.

Newmont’s tier-one portfolio also includes attributable production from the company’s equity interest in Lundin Gold.

"This portfolio provides our shareholders with exposure to the highest concentration of tier-one assets in the sector, each with the scale and mine life to generate strong free cash flows, and all located in the world's most favourable mining jurisdictions,” added Palmer.

With Newcrest in its fold since November 2023, Newmont delivered 5.5-million gold ounces in 2023 at an all-in sustaining cost of $1 444/oz, in line with the revised guidance range for the year.

This year, the miner is targeting gold production of 6.9-million ounces for the total Newmont portfolio, underpinned by 5.6-million gold ounces from the tier-one portfolio.

The gold major reported a net loss of $2.5-billion, driven by $1.9-billion in impairment charges, $1.5-billion in reclamation charges and $464-million in Newcrest transaction and integration costs.

Adjusted net income came to $1.41 a share.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation