Northern Cape copper revival receives yet another promising forward nudge

JOHANNESBURG (miningweekly.com) – South Africa’s prospective Northern Cape province on Tuesday received yet another promising forward nudge along the road to copper-revival in the form of development obstacles being moved out of the way for Orion Minerals.

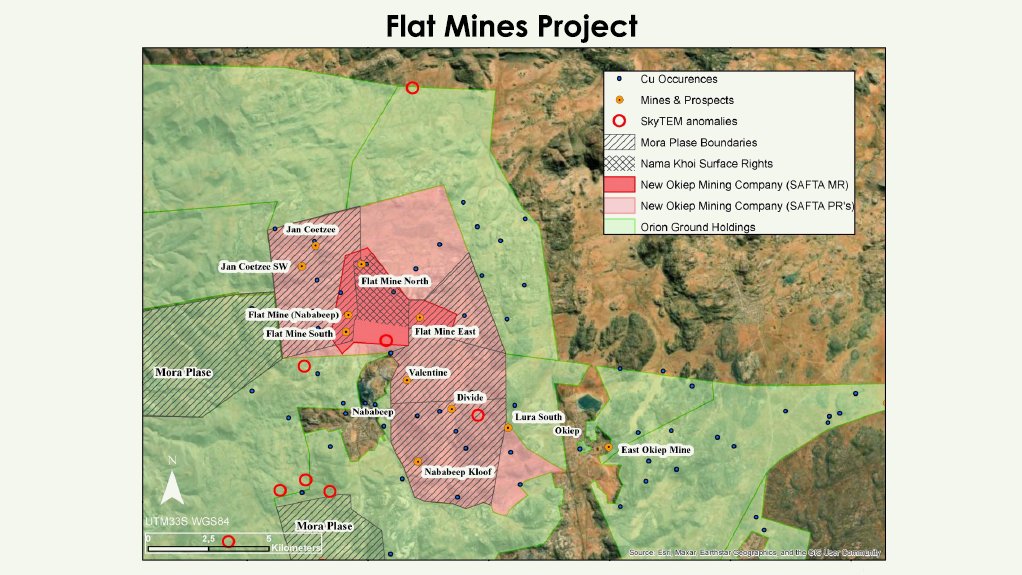

New surface right access and property acquisition will now allow Orion to advance its Flat Mines Project, for which a bankable feasibility study (BFS) is being carried out by the Johannesburg- and Sydney-listed company.

“This is a very important milestone for the New Okiep Mining Project,” Boksburg-born Orion CEO Errol Smart commented in a release to Mining Weekly.

The milestone centres on an agreement being reached to access and acquire Mora Plase surface ownership rights to Farm Nababeep and Farm Plaatjesfontein, properties which overlie most of the Flat Mines area, which is where Orion’s majority-owned subsidiary, New Okiep Mining, holds an Okiep Copper Project mining right and prospecting right applications.

Overall, Orion is targeting substantial diversified base metal production through the development of the Okiep Copper Project and the Prieska Copper-Zinc Project, also in the Northern Cape.

The historical copper district in which the Okiep Copper Project is located produced more than two-million tonnes of copper over a 150-year period ending in 2003 and Prieska has a recorded historical production of more than 430 000 tonnes of copper and one-million tonnes of zinc from 46.8-million tonnes of sulphide ore milled.

As a result of the latest acquisition, Orion will immediately have access to undertake a drilling programme to confirm the expected metallurgical zonation and geotechnical assessments of the Flat Mines deposits, with the data expected to enhance the outcomes of the BFS.

Ownership of the surface area will also allow Orion to optimise community agriculture as well as solar and wind plants for the future mining operations and the surrounding communities.

The latest surface right ownership also removes any conflict of interest in future surface use, allowing outstanding environmental authorisations and water-use licence and rezoning applications to proceed to completion.

Conflicting land use interests have until now prevented Orion from accessing the surface area to conduct important validation work.

“While the primary access for the deposits is located on municipal land – where we do have an access agreement – important supporting infrastructure such as roads, power transmission, water supply pipelines and, most importantly, ventilation holings will need to be located on the surface, within the newly acquired area,” added Smart.

The acquisition also provides the opportunity to undertake future extensional drilling of the known deposits and resource categorisation drilling.

The surface ownership over the remaining areas that will be impacted in the foreseeable future is by the Nama Khoi local municipality, with which Orion has secured an access and surface use agreement.

Orion has mobilised drill rigs to execute a 3 000 m twin hole drilling programme over the Flat Mines East and Flat Mines North deposits and conduct confirmatory geotechnical and metallurgical test work.

The drilling and test work programme is expected to be completed in the current quarter, with the results to be incorporated into an optimised BFS that will be externally reviewed in the following quarter before release scheduled for June.

Owing to previous lack of surface access preventing validation drilling, reliance has been placed on 128 km of historical Newmont and Gold Fields drilling records validated by 2 331 m of twin drilling by previous owners Southern African Tantalum Mining.

Unfortunately, the drill core from Newmont and Gold Fields is not available for geotechnical studies and test work such as ore sorting. Access to fresh drill core is expected to materially enhance the data.

Additional in-fill and twin hole drilling to be conducted on Farm Nababeep will also provide the required information to improve resource classification at the Flat Mine Nababeep, and Jan Coetzee mines, where 37 km of historical Newmont and Gold Fields drilling has intersected significant mineralisation that provides upside potential for Flat Mines expansion and extension.

Orion is currently not able to include these inferred resources in current mine planning.

As a result of the removal of objections arising from potential conflicts in surface use of the area, Orion’s application for environmental and water right permitting over the Flat Mines and the surrounding prospecting rights will now also be allowed to progress to completion.

The mining right and prospecting rights surrounding the granted mining right contain 18 known mineralised bodies that are mapped and drilled by Newmont and Gold Fields. Although 15 of these mineralised bodies will not be incorporated into the initial BFS, they provide important upside to increase the scale of mine production and extend the life-of-mine.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation