Petra expects diamond prices to show modest recovery in 2025

Williamson diamond mine at steady state.

Photo by Petra Diamonds

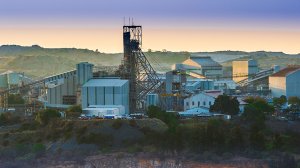

Cullinan diamond mine.

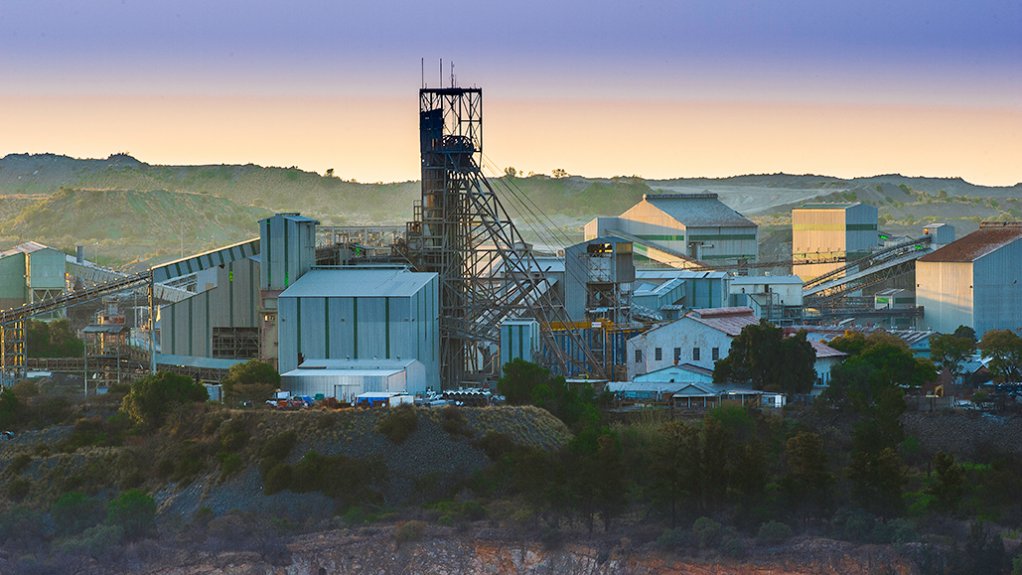

Finsch diamond mine.

JOHANNESBURG (miningweekly.com) – With market fundamentals providing pricing support in the medium- and longer-term, London-listed diamond mining and marketing company Petra Diamonds expects diamond prices to show modest recovery in the new year.

The company expects current diamond market weakness to continue through to the end of the calendar year with some price volatility.

“We’re looking forward to addressing the challenges ahead of us from a position of strength, with world class assets that have long-term potential, strong sustainability credentials and an ability to withstand market and capital cycles,” Petra CEO Richard Duffy stated in a release to Mining Weekly.

The company’s portfolio of mines incorporates interests in the Cullinan, Finsch and Koffiefontein underground mines in South Africa, and the opencast Williamson mine in Tanzania. Koffiefontein is on care and maintenance in preparation for a possible sale.

During the company’s 2024 financial year (FY) to the end of June, 36% more diamond carats were sold than in FY 2023, uplifting revenue by 13%.

This increase was driven by Williamson ramping up to steady state and the planned benefit of the delayed sale of the final tender in FY 2023.

Yearly production was below revised guidance at 2.73-million carats.

Ore processed increased to three-million tons from 2.9-million tons, with the Williamson ramp-up increasing production by 0.1-million tons and a steady quarter at Cullinan and Finsch.

Owing to the increasing contribution from 78-Level Phase II, improvements in grade recovery continued at Finsch, where work to resolve the winder issues and the transition from continuous operations to a two-shift, five-day configuration has reduced carats recovered when compared with FY 2023.

Revenue, including revenue from profit share arrangements, amounted to an increased $113-million on the extension of Tender 5 receipt timing.

Operational fourth-quarter capital expenditure totalled $18-million, and net debt decreased to $201-million.

Petra is guiding production of 2.8-million to 3.1-million carats in FY 2025.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation