Sasol plans reviving chemical unit and explore potential IPO

Sasol is looking to revive its international chemical business, including a sprawling US complex, to boost earnings and open up an option to potentially list it, according to the company’s chief executive officer.

The South African maker of fuel and chemicals from coal reported its first loss since 2020 last year and took billions of dollars in writedowns. The company has about $4 billion of debt and suspended dividend payouts. Its shares tumbled 55% in 2024.

Sasol CEO Simon Baloyi, a two-decade veteran of the company, who took over the role in April, sees the company’s $12.8-billion Lake Charles chemicals facility in Louisiana playing a significant role in generating cash and raising investor confidence.

“It’s a fantastic asset that Sasol has and we have to make sure it starts making money,” he said in an interview at Bloomberg’s office in Johannesburg. The company separated the international chemical business from operations in South Africa and has set targets to increase its contribution to earnings and strengthen it as a standalone entity. While chemicals make up about a third of earnings, the regional contribution of the US is just 6%.

“In the future, at the peak of the chemical market, it’s going to give us lots and lots of strategic options to create shareholder value, where you can have an option to either list it by itself or you can merge it with someone else,” Baloyi, 48, said.

Success could mean revising a dark chapter in the company’s history. The Lake Charles Chemicals Project was originally designed to expand Sasol’s operational footprint abroad, but suffered from mismanagement issues, hurricanes and billions of dollars in cost overruns that ballooned the company’s debt.

In 2020, the year it reached completion, Sasol sold a $2-billion stake in the US base-chemicals business to form a joint venture with LyondellBasell Industries to cut debt. It also accelerated an asset-sale program that wrapped up the following year.

The company’s shares have plunged for two straight year and its weighting on the FTSE/JSE Africa All Shares Index has dropped to 0.86% from 3.2% a decade ago.

Baloyi pledged to avoid “a fire sale of assets” that he considers “value destruction.”

A review he announced in August, when the company took a R56.7-billion writedown largely on low chemical prices, is intended in the next three to four year to make the units capable of sustaining their own operating costs and help pay debt interest.

It’s also looking at all assets to determine which “are bleeding cash, which assets need fixing,” and which need to be shut down if they can’t be improved, he said.

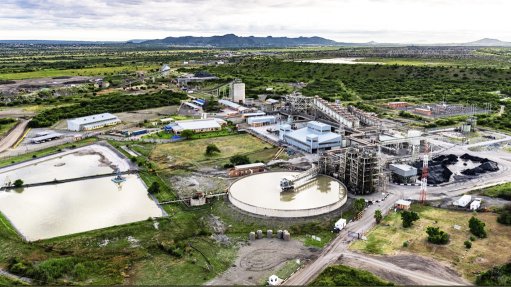

Another unanticipated obstacle to emerge for Sasol in recent years has been the quality of coal it produces and uses to feed its Secunda manufacturing hub.

That’s become another priority and the company has taken a final investment decision on a de-stoning project to improve the quality of the coal, according to Baloyi.

The company has been purchasing about 4 million tons of the fuel a year to make up for the issue, that he considers a waste of money.

“We shouldn’t be buying coal because we have the infrastructure, we have the people, we have everything to mine the coal.”

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation