US, Australia consider tapping public finance vehicles for critical mineral projects

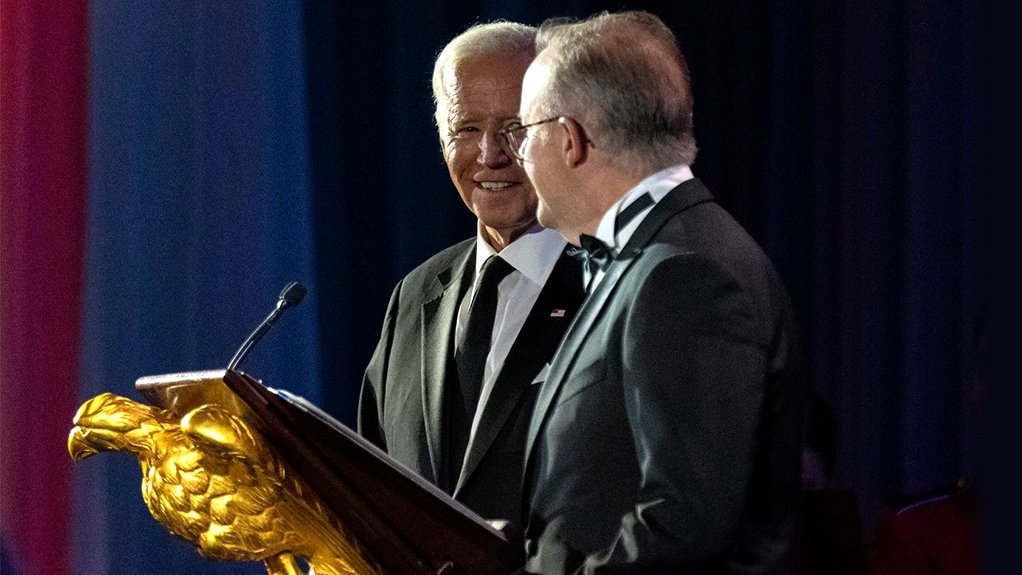

Australian Prime Minister Anthony Albanese visited Washington and met with President Joe Biden this week.

The US Export-Import Bank is being eyed as a venue for boosting investment in Australian critical minerals development to supply components needed in electric vehicles, wind turbines and other technology, Australia’s resource minister said.

The ex-im bank and other public investment vehicles in the US and Australia can be a means “to de-risk some of these projects and then crowd in the private investment that we really want to take hold,” Madeleine King said Wednesday in a roundtable with Bloomberg News in Washington.

Critical minerals have been a top focus as Australian Prime Minister Anthony Albanese visited Washington and met with President Joe Biden Wednesday at the White House. The US and allies have sought Western alternatives to source critical minerals and expand clean energy supply chains beyond China, the world’s dominant provider.

Public finance can help catalyze low-volume critical minerals ventures that are exposed to volatility risk, King said. Those projects can be challenged because “there’s a dominant market player that can change the price of its commodities in basically an instant,” and the smaller size of deposits are “not what big investors want to invest in,” King said.

“So we’ve got to think imaginatively in how governments can incentivize that investment,” she said.

The US and Australia’s shared history and longstanding investment ties can facilitate the work, as the two countries “identify projects that are important for our respective supply chains,” and derive “mutual benefit” from them, King said. “To produce all the things we need to transform our economies, no one can do it alone.”

For instance, King said, Australia’s “great natural endowment” of lithium and other critical minerals is an opportunity to supply the US as it boosts clean energy manufacturing with expanded federal support from last year’s sweeping climate law. And in Australia, minerals processing to refine those materials is another rich source of potential jobs.

“We’re not going to waste the opportunity of what the world needs, and more than just extracting it, we want to make sure we go further along that value chain into processing,” King said.

King, who last year told Bloomberg that breaking China’s grip on the critical minerals supply chain was a “pipe dream,” said China has a 20- to 30-year head start in developing the supply chain for the green energy transition. This largely occurred, she said, as Western democracies turned away from mining. But now, “because we know we need these critical minerals and rare earths for the green energy transition, we want to make sure we can all get hold of them,” King said separately in a Bloomberg Television interview.

King, whose country just announced a A$2 billion ($1.3 billion) expansion in critical minerals financing, said investment in middle-income countries also will be essential. China, which is well-known for investing directly in projects across the globe, also invests significantly in building out costly infrastructure for those sites and facilities — a move that benefits local communities.

A Western-based approach for critical mineral investments abroad will bring sustainability standards to levels that aren’t always a focal point of China, King said. Cooperating and collaborating in places such as Africa for mining and investment will benefit communities and create more ethical products that will attract Western businesses, she said.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation