Gem Resources ends first half on solid financial, strategic footing

In his first address as executive chairperson of gemstone mining company Gem Resources, Louis Ching says the group now has the operational progress, strengthened financial position and strategic initiatives in place to advance its Gravelotte and Curlew mines, as well as establish innovative financing and marketing channels.

This despite a subdued gemstone market.

Gem Resources’ Gravelotte project is based in South Africa, while its Curlew project is based in Australia.

In the six months ended June 30, Gem Resources advanced two pivotal initiatives – an updated treasury policy and an offtake and pre-financing agreement – that help define the group’s future trajectory.

The board proposed a strategic and transformative update to Gem Resources’ treasury policy under which surplus funds may be allocated into leading cryptocurrencies such as Bitcoin, Ethereum and Solana.

The company aims to diversify its liquid assets, strengthen financial flexibility and align the group’s capital management practices with that of innovative global resource companies.

In support of this proposed policy, Gem Resources is internally developing a proprietary algorithmic entry strategy designed to optimise potential returns within the parameters of the treasury policy.

This forward-looking approach will serve both as a hedge and as a way of integrating the company into the digital finance ecosystem – an area of growing importance to global investment and commodity trade.

Moreover, after the reporting period, Gem Resources progressed negotiations to secure a significant offtake and pre-finance trade agreement for its Gravelotte emerald production.

“We are in advanced discussions with leading tokenisation and commodity trading partners to establish a direct offtake structure.

“The intent is to provide upfront liquidity for mine development while opening access to broader global sales channels – including decentralised platforms – thereby accelerating growth and maximising the value of the group’s assets,” Ching explains.

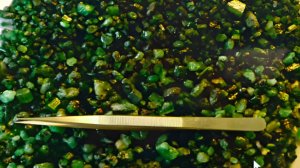

During the period under review, Gem Resources started with hard-rock mining at the Cobra openpit in South Africa, which confirmed Gravelotte’s geological model and production potential.

Early test sales, although modest, have validated the company’s processing methods and provided proof of concept for commercialisation despite the challenging backdrop in the gemstone sector.

The first trial sales of emeralds from Gravelotte generated gross proceeds of about $57 000.

In respect of other financials, Gem Resources recently completed a transformational £2.1-million recapitalisation, which comprised a £617 320 equity subscription and the issue of £1.5-million unsecured convertible loan notes. The refinancing has provided critical working capital for the group, as well as addressed the company’s poor financial condition that had been a concern in earlier reporting periods.

Ching is confident that the company now has the resources and structure to pursue its strategic objectives, including advancing in-pit exploration at Gravelotte to improve resource definition and pit optimisation, as well as processing upgrades.

At the Curlew mine, the company will focus on exploration, development and progression towards a restart of operations.

Gem Resources also plans to undertake exploration activity in Zambia.

“With solid measures in place, the company is equipped to deliver operational progress, unlock value from its asset base and move closer to establishing itself as a sustainable and reliable participant in the global emerald market,” Ching concludes.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation