Glencore to continue to oversee responsible decline of thermal coal operations

JOHANNESBURG (miningweekly.com) – Diversified mining and marketing company Glencore is to continue to oversee the responsible decline of its thermal coal operations over time, the board has decided.

While the decision has been taken to retain this business today, the board preserves the option to consider a demerger of all or part of this business in the future if circumstances change.

Following completion of the acquisition of a 77% interest in Elk Valley Resources (EVR) last month, Glencore undertook a consultation process to assess shareholder views regarding retaining or demerging the coal and carbon steel materials business.

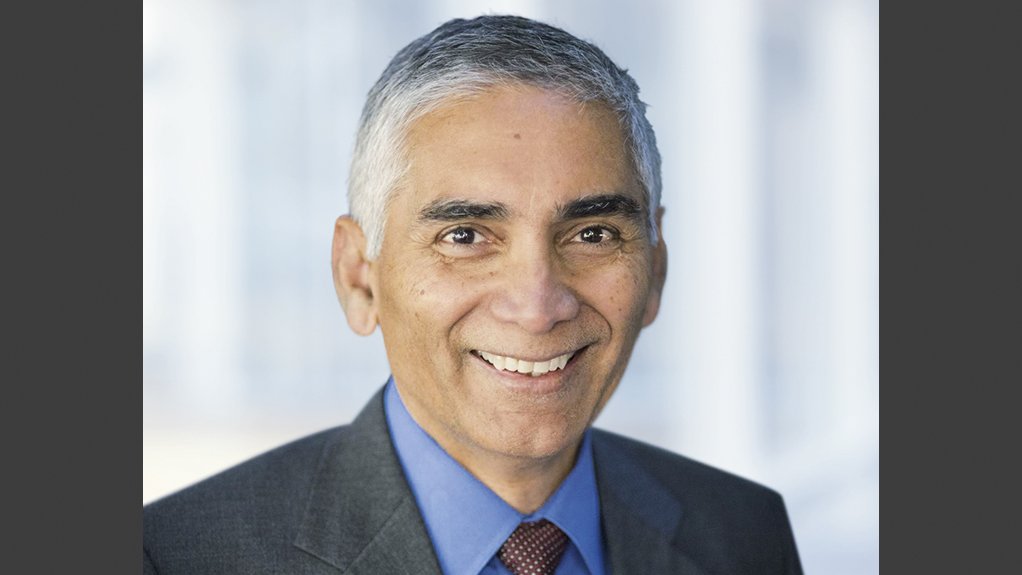

“Following extensive consultation with our shareholders, whose views were very clear, and our own analysis, the board believes retention offers the lowest risk pathway to create value for Glencore shareholders today,” Glencore chairperson Kalidas Madhavpeddi commented in a release to Mining Weekly.

“The expected cash generative capacity of the coal and carbon steel materials business significantly enhances the quality of our portfolio, by commodity and geography, and broadens our ability to fund our strong portfolio of copper growth options as well as accelerate shareholder returns,” Madhavpeddi added.

The board also noted that, in line with the 90%-plus-backed 2024-2026 Climate Action Transition Plan (CATP), Glencore would continue to oversee the responsible decline of its thermal coal operations over time.

Glencore would also assess how best to integrate the EVR assets into the climate transition strategy, having regard to its commitment to develop and adopt a climate transition strategy for EVR, and recognising that the transition away from steelmaking coal for steel production would be slower than thermal coal.

With the decision to retain the coal and carbon steel materials business, the previous net debt cap shaping shareholder returns framework is immediately reset at around $10-billion.

WIDESPREAD CONSULTATION

Shareholders representing an estimated two-thirds of eligible voting shares were consulted for their views.

Over 95% of shareholders that specifically expressed a preference for retention or demerger supported the retention of the coal and carbon steel materials business, primarily on the basis that retention should enhance Glencore’s cash-generating capacity to fund opportunities in its transition metals portfolio, such as its copper growth project pipeline, as well as accelerate and optimise the return of excess cash flows to shareholders.

Numerous shareholders also expressed scepticism on the scale of a potential MetalsCo – the remaining business – valuation uplift arising from a demerger and did not see separation as environmental, social and governance positive given the wide support for the latest CATP, including the thermal coal decline strategy, and the belief in the important role that steelmaking coal is expected to play in supporting the infrastructure needed for the energy transition.

Some shareholders also abstained from offering a specific preference, principally advising that consideration of a demerger is a strategic decision for the board.

The outcome of the consultation process and the group’s own analysis led the board to conclude that, between the options of retaining or demerging, considering both risk and opportunity scenarios, retention of the coal and carbon steel materials business currently provided the optimal pathway for demonstrable and realisable value creation for Glencore shareholders.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation