Franco-Nevada buys 1% royalty on AngloGold’s Arthur project

Gold-focused royalty and streaming company Franco-Nevada has acquired a 1% net smelter return (NSR) royalty on AngloGold Ashanti’s Arthur gold project near Beatty, in Nevada, for $250-million in cash, with a potential $25-million top-up.

The royalty, purchased from Altius Minerals, covers a substantial portion of the project’s resource base and has no step-downs or buydown provisions. A further contingent payment of $25-million is tied to the outcome of an arbitration process between Altius and AngloGold that could expand the royalty footprint across more of the project.

Altius will continue to hold a remaining 0.5% NSR royalty interest in the Arthur project.

“We are pleased to acquire this existing royalty on the Arthur gold project, which is one of the most exciting new gold discoveries in Nevada,” Franco-Nevada CEO Paul Brink said in a statement.

“AngloGold, a Tier-1 operator, has been rapidly growing the resource base at Arthur since its initial discovery in 2018.”

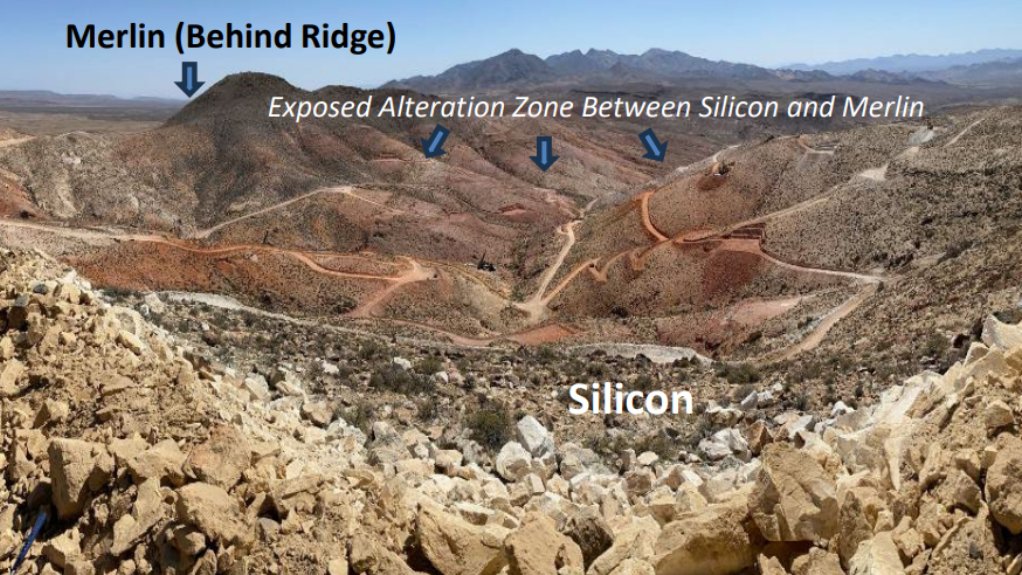

AngloGold’s Arthur project – renamed from the Expanded Silicon project – now hosts 3.4-million ounces of indicated and 12.9-million ounces of inferred gold resources, after a 20% year-on-year resource expansion. The company has drilled 430 km to date, including 132 km last year using nine rigs.

Franco-Nevada funded the transaction using cash on hand and a $175-million draw from its $1-billion credit facility. The deal also gives Franco-Nevada pre-emptive rights over Altius’ remaining 0.5% royalty interest.

AngloGold is targeting the completion of a prefeasibility study by late 2025 or early 2026. The project is envisioned as a large-scale oxide operation combining heap leach and milling.

In a separate statement, Altius CEO Brian Dalton said that the decision to retain a third royalty interest in the project provided shareholders with continuing growth exposure to the emerging US gold district.

"We now look forward to the ability to explore a wider set of capital allocation and deployment opportunities, facilitated by a considerably strengthened balance sheet and liquidity profile, and to further growing shareholder value," he said.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation