The bearings that keep modern mining moving

(Fig.1.2.) Top 5 Countries' Market for Mining Bearings

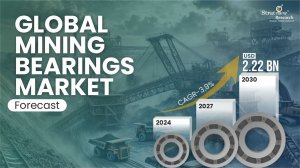

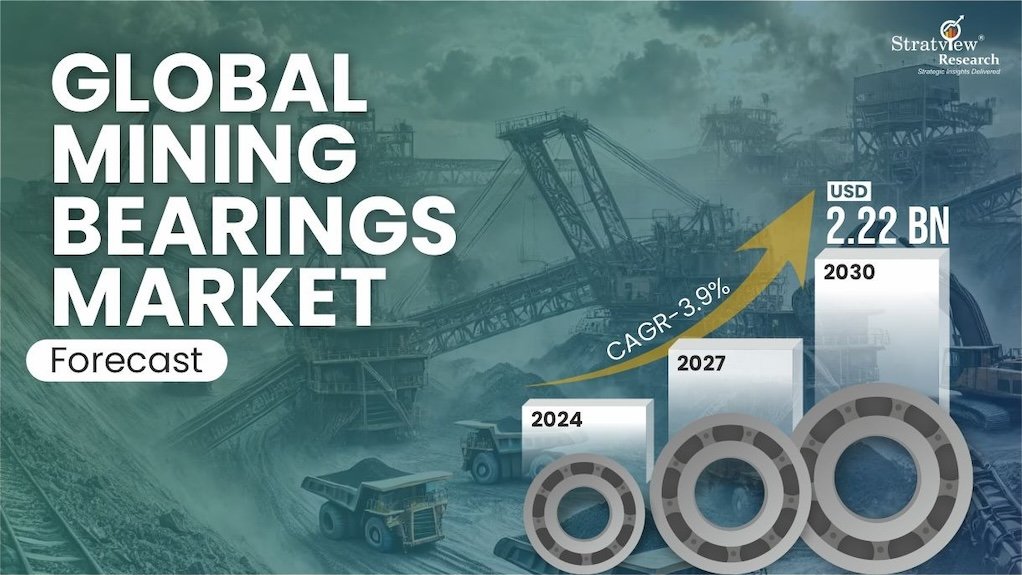

Global mining bearings market

This article has been supplied and will be available for a limited time only on this website.

Unearthing precious metals calls for some heavy-duty work that needs a highly reliable set of equipment. From crushers and conveyors to drilling rigs, every bit of mining equipment requires strong, high-performance bearings that sustain in efficiency and ensure uninterrupted functioning of mining operations.

Because mining environments involve relentless heavy loads, extreme temperatures, contamination risks, and frequent shock events, heavy-duty metals remain the preferred material choice for mining bearings even today. More than 80% of bearings deployed across mining applications today are metal-based, primarily manufactured from steel and metallic alloys such as bronze, aluminum-based alloys, and zinc-based alloys. Non-metallic alternatives, including engineered polymers, phenolic composites, etc., remain confined to selected, niche functions.

Though small in size compared to huge mining equipment, these components pack the muscle to keep some of the world’s heaviest mining machines moving with effortless precision. With their role defined, let us assess how the broader mining bearings market is evolving across materials, applications, and regional dynamics.

Bearing Demand Led by Crushing, Screening, and Conveying Systems

In a typical mine, the most severe load and vibration conditions originate from primary crushers, scalpers, and high-capacity belt conveyors. These assets are engineered for continuous duty cycles under abrasive, shock-prone conditions, an operating environment where bearing robustness directly influences throughput and maintenance cycles. As a result, ~30% of total mining bearing demand is tied to crushing and conveying equipment OEMs and their associated aftermarkets.

Haulage fleets remain another significant bearing consumer, though demand volumes are slightly lower than that of crushing and conveying machinery. The segment’s consistency, however, is supported by the long equipment life cycles and global fleet expansion.

According to GlobalData’s Global Surface Mining Equipment: Populations & Forecasts to 2030 (Dec 2024), the global surface mining equipment fleet (excluding quarries) totaled ~155,976 active machines. The fleet is forecast to grow to 170,982 units by 2030, with haul trucks accounting for the largest share of additions. This fleet expansion, combined with rebuild cycles every five to seven years, and added maintenance when required, creates stable replacement demand for bearings.

Common Bearings in Mining Operations

Bearings deployed in mining span a broad technical spectrum. The primary categories include:

Roller Bearings (tapered, cylindrical, spherical) – preferred in high radial load and shock environments, such as crushers, conveyors and haul truck wheel ends.

Ball Bearings – used where precision and high-speed operation are required.

Plain Bearings – applied in pivot and oscillating applications where contamination exclusion and cost-effectiveness are priorities

While all types of bearings have their own importance and application value across different equipment, more than two-thirds of all bearings used across the industry are roller bearings, due to their ability to handle heavy loads and accommodate misalignment under harsh operating conditions. Their ability to absorb misalignment, manage persistent radial loads, and sustain operation under impact events makes them indispensable across haulage, crushing, conveying, and processing systems.

APAC Leads the Global Curve in Both OEM and Aftermarket Demand

If we look at the overall scenario, the mining bearings business is driven far more by aftermarket demand than OEM fitment, with nearly 70% of global consumption coming from replacement cycles.

APAC remains the largest demand generator for both equipment demand and bearing consumption. One of the reasons behind this dominance is the region’s sheer scale of mining activity. According to 2023 data from World Mining Data, global mineral production reached ~19 billion metric tons, with Asia Pacific accounting for over 60%, i.e., nearly 12 billion metric tons.

Top 5 Countries’ estimated Value (Fig.1.2.)

The region also houses a substantial share of global bearing manufacturing capacity, concentrated in China, Japan, and India. China’s position as the world’s largest producer of coal, iron ore, rare earth elements, graphite, and battery minerals fuels significant demand for high-performance bearings. It also hosts major bearings manufacturers such as C&U Group, LYC Bearing Corporation, and HRB Group, giving APAC a strong cost and supply-chain advantage and driving nearly 40% of worldwide mining bearings demand.

Apart from China and the USA, Brazil, Australia, Russia, and Turkey are among the top national markets for mining bearings. This ranking reflects sustained mining activity, fleet size, and equipment replacement demand in these countries.

Concluding Thoughts

The mining industry, one of the foundation pillars of human development for centuries, is now witnessing technological transformation. Different reports suggest, implementation of new technologies to mining processes can add >20% gains. From the days of pickaxes and shovels to today’s deployment of autonomous haul trucks, drones, artificial intelligence, and real-time analytics, mining has undergone a massive leap in innovation, and with no surprise, bearings have also undergone modernisation.

Today, we have mining bearing OEMs including AB SKF, The Timken Company, Schaeffler Group, etc. manufacturing smart bearings embedded with sensors that allows for real-time monitoring of bearing health and performance, self-aligning capability to help mitigate misalignment, and more.

This technological leap coincides with the accelerating global clean-energy transition, which is driving unprecedented demand for critical minerals such as lithium, cobalt, nickel, and copper.

UN Trade and Development (UNCTAD) projections based on data from the International Energy Agency (iea.org) indicate that by 2050, lithium demand could rise by over 1,500%, with similar increases for nickel, cobalt and copper. With the rising demand for critical minerals comes a heightened need for more mining and even more efficient mining solutions.

Given this trajectory, two outcomes are evident:

Rising demand for new mining equipment to support expanding production, and

Increased maintenance and overhaul requirements for the existing fleet to sustain operational efficiency.

In both cases, the requirement for bearings will be unavoidable. The mining industry is emerging, indicating a healthy growth due to various factors including favorable government policies, rising commodity prices, technological advancements in mining equipment, etc. This positive trend is expected to drive the global mining bearings market to cross an impressive US$ 2.2 billion value by 2030.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation